I was talking to someone today, that startup molecular labs should have incentives to strategically partner with "big labs" because the former have the novel science and the latter have all the runways and bridges in place, such as relationships with all major payors. Ready for the turn-key. It should be win-win.

Here's an example, written entirely by AI, of a smaller lab Monogram that contracted, partnered, was acquired by Labcorp. I have not vetted this AI written article.

###

Monogram Biosciences, Inc.

Here’s a summary of what happened with Monogram Biosciences (the South San Francisco lab you referred to) — its background, key assays (including tropism/CCR5), acquisition, and present status.

Background & assays

-

Monogram was based in South San Francisco, CA, and was a molecular diagnostics company focused on HIV (and later oncology) specialty assays. (Wikipedia)

-

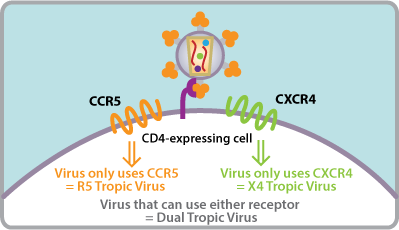

Among its key products was the Trofile® assay assay, which determines HIV-1 co-receptor tropism (i.e., whether HIV uses CCR5 vs CXCR4) — used to guide use of CCR5-antagonist therapy. (Clinical Lab Products)

-

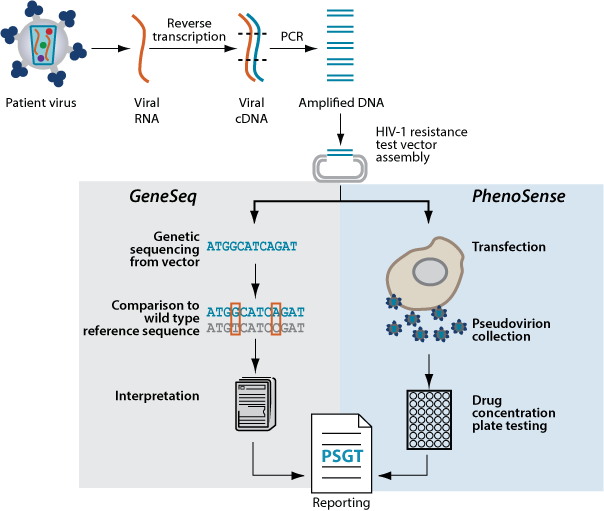

Another core offering was the PhenoSense®/PhenoSense GT® assays (phenotypic resistance tests) and GenoSure genotypic assays for HIV drug-resistance. (Clinical Lab Products)

-

The company also developed oncology/companion diagnostics (e.g., via its VeraTag® platform) but its HIV work appears to have been its signature specialty. (Dark Daily)

Hence your recollection about CCR5-receptor (tropism) testing is correct: Monogram’s Trofile was used to determine eligibility for CCR5 antagonists.

Acquisition and what became of it

-

On June 23, 2009, Laboratory Corporation of America Holdings (LabCorp) announced a definitive agreement to acquire Monogram for $4.55 per share, or approximately US$106.7 million equity value (≈US$155 million enterprise value) at the time. (Reuters)

-

The acquisition was completed in the third quarter of 2009, making Monogram a wholly-owned subsidiary of LabCorp. (Labcorp Investor Relations)

-

After acquisition, Monogram’s assays continued to be offered under the Monogram brand (within LabCorp’s infrastructure) for HIV resistance, tropism and some oncology tests. For example, the Monogram website (now under the LabCorp domain) lists the HIV portfolio: resistance, tropism, viral load. (Monogram Bio)

-

The physical location (345 Oyster Point Boulevard, South San Francisco, CA) is referenced in Monogram’s sample-handling & shipping instructions as part of LabCorp’s network. (Monogram Bio)

Thus, Monogram did not disappear entirely — rather it was absorbed into LabCorp’s diagnostics business, and its HIV assay portfolio continues under that umbrella.

Current status

-

On LabCorp’s Monogram page you’ll still find the test offerings: e.g., Trofile®, GenoSure®, PhenoSense®, etc. (Monogram Bio)

-

The branding is “Monogram Biosciences, Inc.” but functionally it is a LabCorp unit — so for many practical purposes it’s part of LabCorp’s lab network.

-

For your purposes (in genomics/medtech consulting) it means that when you see Monogram’s HIV tropism and resistance assays, they are still active commercially but under LabCorp’s ownership.

Implications / What a consultant should note

-

If you were researching “What happened to Monogram?” the answer: they were acquired, and their platform was integrated into a larger clinical-lab company rather than being spun off or shut down.

-

The Trofile CCR5 tropism assay remains a relevant diagnostic (or at least historically important) for HIV therapy selection, and Monogram’s resistance assays are still in market.

-

From a strategic vantage: this acquisition is a case of a diagnostics specialist being subsumed by a major lab company to scale up personalized-medicine diagnostics — classic for the era of mid-2000s molecular diagnostics.

-

If you are assessing the competitive/market landscape for HIV resistance/tropism testing, you’d now look at LabCorp’s assay offerings (which include Monogram’s heritage) rather than a standalone Monogram entity.

-

If you were investigating reimbursement/regulatory strategy: Monogram’s assays had to navigate these before acquisition, and under LabCorp the infrastructure (billing, regulatory compliance, CLIA accreditation) is handled within a larger company, which may change strategic dynamics.

If you like, I can look up exactly how Trofile’s market share has evolved, any regulatory changes, and how the assay portfolio has shifted since the acquisition (e.g., to next-gen sequencing tropism, etc.). Would you like me to dig into that?

Short version: Monogram Biosciences didn’t disappear—it was acquired by Labcorp in 2009 and still operates in South San Francisco (345 Oyster Point Blvd.) as a Labcorp specialty lab. Its signature HIV assays (including the phenotypic Trofile® CCR5/CXCR4 tropism test and PhenoSense®/GenoSure® resistance tests) continue to be offered under the Monogram/Labcorp banner. (Reuters)

Why you remember CCR5/“tropism” testing: Trofile was the go-to phenotypic assay used to determine whether a patient’s virus was CCR5-tropic (vs CXCR4), which guided use of the CCR5 antagonist maraviroc (Selzentry®). FDA labeling has long required a highly sensitive tropism assay before starting maraviroc, and U.S. HIV guidelines still say to do a tropism test if a CCR5 antagonist is being considered (or at failure on one). (FDA Access Data)

What changed since then (and why you don’t hear about it as much):

-

Enhanced sensitivity (Trofile-ES): Around 2008–2011, Monogram rolled out an enhanced-sensitivity version that better detected minority CXCR4 variants and was used in re-analyses of pivotal trials. (aidsmap.com)

-

Genotypic tropism rose: Over the 2010s, V3-loop sequencing/genotypic algorithms (e.g., geno2pheno) showed good concordance with Trofile in studies and were cheaper/faster, so many centers shifted to genotypic tropism when they needed it. (PMC)

-

Clinical demand shrank: Modern ART favored INSTI-based first-line regimens, and maraviroc remained niche; guidelines only call for tropism testing when a CCR5 antagonist is on the table. Net effect: fewer tropism tests overall, even though the assay remains available. (That’s an inference consistent with guideline use and drug positioning rather than a published market-share figure.) (ClinicalInfo)

Current status: Monogram pages on Labcorp still list Trofile, GenoSure, PhenoSense, and related offerings; the site also shows shipping to the South San Francisco address with CLIA/CAP credentials. (Monogram Bio)

If you’d like, I can pull together a one-pager with: (a) where Trofile is used today, (b) how labs decide between phenotypic vs genotypic tropism, and (c) quick reimbursement notes (historic list pricing, typical payer language).